Table of Content

It may be a good idea for property owners with unhedge funds to refinance their assets in cash. A low loan balance and solid cash flow are desirable qualities for some investors who wish to keep their equity intact. Owners of other rental properties refinance their accumulated equity using cash-out refinancing. It may appear incomprehensible to those who have never owned multiple rental properties. However, if you put in the effort and have the necessary preparation, you can make that dream a reality.

In general, lenders consider the amount of the loan, the borrower’s current debt-to-income ratio, the borrower’s credit score, and the length of the loan when approving a home equity loan. A borrower with a good credit score and low debt-to-income ratio may be approved for a home equity loan without having to put in a large down payment. In addition, borrowers with less-than-stellar credit scores or high debt-to-income ratios may need to put down a larger down payment. Even if you have a good credit score and a low debt-to-income ratio, a high purchase price may prevent you from obtaining a home equity loan.

What are the disadvantages of a Fannie Mae loan?

Prior to 2011, when the price was deemed too low to be eligible for trading according to the rules of the exchange, Fannie Mae was traded on the NYSE. The NYSE is a public exchange where stock prices are generally transparently updated ... You should shop around all of the local institutions to see what ... The judgement will have to be paid off unless it has expired or been declared in a Chapter 7 bankruptcy and the bankruptcy wait period has expired. This can be an obstacle for self-employed individuals or employees who are able to claim business-related deductions.

The owner’s credit score can be negatively affected by a new debt arrangement. If you chip in an extra $25 per month toward the principal, the balance and interest will be reduced. If you follow the steps on your mortgage servicer’s website, you should be able to complete this task. If you decide to refinance, you should get quotes from multiple lenders. In most cases, if you prefer another company, they will quote the same amount for you. When it comes to terms and timelines, it is critical to take into account the interest rate as well.

Single Family

When inquiring about a loan on this site, this is not a loan application and we are not affiliated with your current mortgage servicer. This site will connect you with businesses who may provide additional product information and/or assist you with eligibility requirements. Reserves represent the number of mortgage payments lenders want to see in your account in case you experience a loss of income or other financial hardship. Your reserves could be up to 6 months with a Fannie Mae loan, although 2 months is generally a good starting point. For second homes and investment properties, the down payment requirements are higher, but for a 1-unit primary residence, the down payment needed could be anywhere from 3% – 5%.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Forbearance is a form of repayment relief involving the temporary postponement of loan payments, typically for home mortgages or student loans. If your DTI ratio is too high, you can make a larger down payment, which will reduce your monthly costs. While a 20% down payment is considered ideal, some borrowers may be able to put as little as 3% down. Along with avoiding subprime loans mentioned above, lenders must meet eligibility and underwriting criteria that ensure the credit quality of the financing.

Is Fannie Mae stock on the market?

When you borrow private notes, you are not restricted in how many mortgages you can have. If you are concerned about financing your property, a revolving line of credit may be an option. Real estate investors must have a variety of financing options available to them in order to finance their properties. Mortgage loans for first-time home buyers or those looking to purchase a rental property are an excellent option, but you quickly reach the point where you are unable to borrow more than you can afford.

Lenders currently focus most of their mortgages on terms set by Fannie Mae so they can be purchased on the secondary mortgage market. If Fannie Mae didn't exist, we would possibly see laxer requirements on mortgages purchased by non-government entities on the secondary mortgage market. Or we might see lenders faced with liquidity issues once their main purchaser of mortgages is out of the industry. Those lenders may make it harder for people to get mortgages if they don't have the capital to hold the debt of more mortgages. Following the mortgage meltdown, Fannie Mae began to focus on loan modifications. Loan modifications change the conditions of an existing mortgage to help borrowers avoid defaulting, ending up in foreclosure, and ultimately losing their homes.

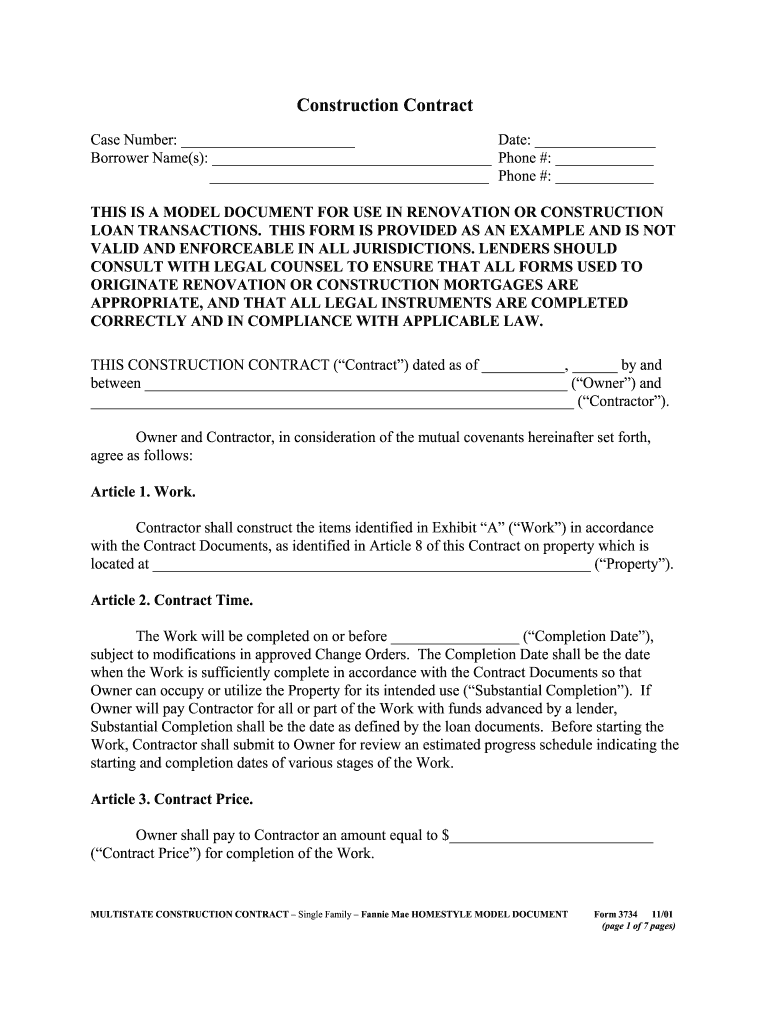

The FHA 203k mortgage is another popular rehabilitation loan offered by the Federal Housing Administration. Understand that you aren’t the only one who has to meet Fannie Mae’s requirements. You also need to choose a licensed contractor to complete the bulk of the work.

Here's a summary of Fannie Mae's operations, the loan products it offers and how you apply. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013.

The agency's website lists all borrower requirements and provides a do-it-yourself tutorial to help you see if you're eligible. When you've completed this self-assessment tutorial, the website automatically provides a Uniform Residential Loan Application. And while they don't lend directly to homebuyers, they still play an important role in financing home loans. By purchasing mortgages and selling them to investors, Fannie Mae and Freddie Mac free up cash for banks, mortgage companies and other lenders to finance home purchases. This also helps keep down interest rates and stabilizes the lending market. In most cases, you do not need to provide a comprehensive analysis of the rental property you intend to purchase or refinance.

Closing cost assistance is paid by Fannie Mae, and delivered to your closing. In order to be eligible, buyers must only complete an online course on homeownership, pay a $75 fee (which is refunded in-full at closing), and print their education completion certificate for “the file”. In 2016, Fannie Mae underwrote more than $393 billion of residential mortgages.

No comments:

Post a Comment